CAS is against fraud. It’s wrong. It impacts on our overall economy. Unfortunately it occurs in all economies and in all parts of the economy. Benefit fraud is a problem, however it seems to get more attention than other fraud, so we thought we’d set out the position within the UK’s finances.

The UK government estimates that total fraud across the whole of the economy amounts to £73 billion a year. UK government figures for 2012 estimate benefits overpaid due to fraud is £1.2 billion and tax credit fraud is £380 million. So just under £1.6 billion in total; less than 1% of the overall benefits and tax credits expenditure and less than benefits underpaid and overpaid due to error.

It's a lot of money, and it’s never right, but unfortunately fraud happens in many walks of life. Sometimes it helps to compare the figures with other fraud or error. More than this amount was overpaid in benefits due to claimant and official error. That was £2.2 billion in 2011/12 and is recovered by the UK Government. Equally claimant and official error led to £1.3 billion benefits being underpaid.

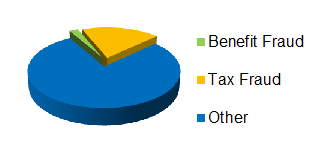

So to get some perspective, benefit fraud represents 2% of the estimated total annual fraud in the UK. Public sector fraud, which includes benefit fraud, is £20.3 billion a year, so within this category it accounts for just under 8%. The majority of this £20 billion is tax fraud which costs the economy £14 billion annually, or 69%. So we can see that both in absolute and percentage terms tax fraud is a much bigger issue than benefit fraud. In fact, out of all the categories of fraud calculated by the UK Government, benefit fraud is the second lowest. Only identity fraud which costs individuals £1.4billion a year comes below it.